indiana tax payment voucher

Box 6102 Indianapolis IN 46206. Then follow the links to select payment type enter your information and make your payment.

Our Annual Chili S Fundraiser Begins This Wednesday June 1st Print Out The Voucher And Make Plans To Dine There Soon Fundraising Voucher Print

18 2022 Mail entire form and payment to.

. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 9-20 Spouses Social Security Number. If paying by credit card a fee. Payments can be made by Visa MasterCard or ACH e-check.

Box 6079 Indianapolis IN 46206-6079 IT-41ES Vouchers PO. 15 2020 4th Installment payment due Jan. Mail entire form with any payment due by April 15 2021 to.

Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 12-19 Spouses Social Security Number. 18 2011 Mail entire form and payment to. If paying by credit card a fee will be.

Indiana payment vouchers No you are not required to pay the estimated tax vouchers for 2017 which were generated to assist with tax planning and avoiding tax penalties for the current year. Indiana Department of Revenue PO. Box 7206 Indianapolis IN 46207.

Using TaxAct Indiana - Printing the Post Filing Coupon PFC Payment Voucher If you owe Indiana state taxes a post filing coupon PFC will print with your return. 15 2022 4th Installment payment due Jan. 1st Installment payment due April 15 2021 2nd Installment payment due June 15 2021 3rd Installment payment due Sept.

As a result Indiana taxpayers cannot use the federal unemployment compensation exclusion on their 2020 Indiana individual income tax returns and that income must be added back in. Follow the links to select payment type then enter your information and make your payment. Form IT-41ES is an Indiana Corporate Income Tax form.

18 2022 Mail entire form and payment to. State Form 21006 R20 9-20. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R8 9-09 149091101 149091101 Spouses Social.

Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R22 12-21 Spouses Social Security Number. Avoid penalties by never missing your payment deadline again. Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R19 9-20 Spouses Social Security Number.

Place an X in the box if you are not intending to make a payment with this form _____ No Payment. 1st Installment payment due April 15 2010 2nd Installment payment due June 15 2010 3rd Installment payment due Sept. Box 6192 Indianapolis IN 46206-6192 Form IT-41 without Payment PO.

1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. EFT allows our business customers to quickly and securely pay their taxes. Form IT-41 with Payment PO.

17 2023 Mail entire form and payment to. Indiana Department of Revenue PO. Box 6192 Indianapolis IN 46206-6192 Form IT-41ES State Form 50217 R11 8-21 25521111694 25521111694 IT-41ES Fiduciary Payment Voucher Instructions Fiduciary representatives may use the IT-41ES Fiduciary Payment Voucher to make a payment for a trust or an estate.

Installment Period Information Place an X in the appropriate box to show which payment you are making. The request can be made by calling 317 232-0129 or in writing to. Do not attach Form IT-9 to your tax return when filing.

Entitys Composite Adjusted Gross Income Tax Return. 1st Installment payment due April 15 2021 nd 2 Installment payment due June 15 2021 3rd Installment payment due Sept. To begin go to the INTIME website at intimedoringov and select the Make a Payment link under the Payments section.

15 2021 Mail entire form and payment to. Indiana Department of Revenue PO. More than one IT-6WTH may be remitted in a taxable period.

Indiana Department of Revenue PO. 1st Installment payment due April 15 2020 2nd Installment payment due June 15 2020 3rd Installment payment due Sept. Beneficiarys Share of Indiana Adjusted Gross Income Deductions Modifications and Credits.

If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. 430 pm EST. Indiana Fiduciary Income Tax Return.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it. Indiana Department of Revenue PO. To begin go to INTIME at wwwintimedoringov and select the Make a Payment link under the Payments section.

Payments can be made by Visa MasterCard or ACH e-check. To learn more about the EFT program please download and read the EFT Information Guide. If you expect to receive a refund there is nothing to mail and the PFC will not print This form must accompany any payment you make to the Indiana Department of Revenue.

Indiana Estimated Tax Payment Voucher Download This Form Print This Form It appears you dont have a PDF plugin for this browser. Indiana Department of Revenue PO. IT-41 Schedule IN K-1.

15 2021 4th Installment payment due Jan. 15 2022 4th Installment payment due Jan. More about the Indiana Form ES-40 Estimated eFile your Indiana tax return now.

Indiana Department of Revenue. Indiana Department of Revenue PO. Additional IT-6WTH vouchers must be requested by contacting the department.

17 2023 Mail entire form and payment to. Please use the link below to download 2022-indiana-form-es-40pdf and you can print it directly from your computer. Federal tax relief contained in the American Rescue Plan Act which excludes up to 10200 of unemployment compensation from federal adjusted gross income was not adopted by Indiana.

15 2010 4th Installment payment due Jan. You can find information on how to pay your bill including payment plan options FAQs and more below. Indiana Department of Revenue PO.

When you receive a tax bill you have several options. Box 7226 Indianapolis IN 46207-7226 Fiduciary. Since the change in your tax situation is not expected to repeat during the current year the estimated tax payments would not apply they are not a requirement just a.

1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. Avoid penalties by never missing your payment deadline again. 15 2021 4th Installment payment due Jan.

For more information call 317 232-5500. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How To File And Pay Sales Tax In Indiana Taxvalet

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Explore Our Example Of Salary Payment Voucher Template In 2020 Salary Best Presentation Templates Templates

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

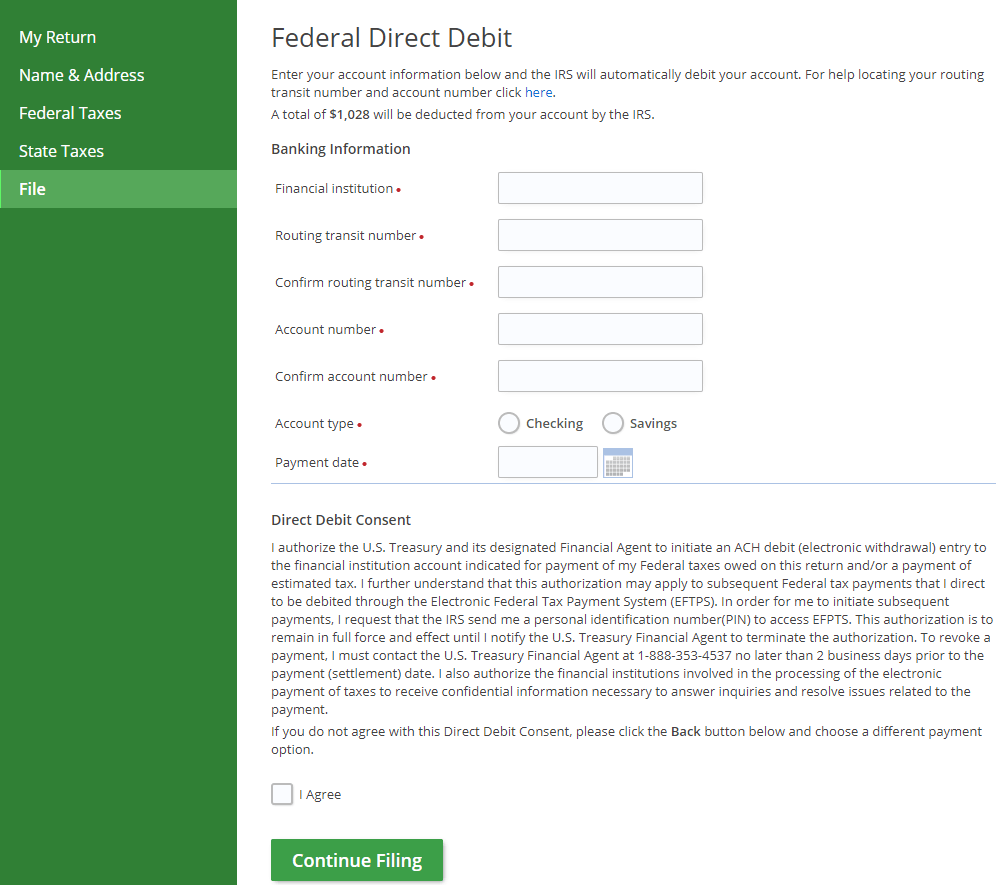

Pay Your Federal State Taxes On Efile Com Debit Check

How To File And Pay Sales Tax In Indiana Taxvalet

Our Annual Chili S Fundraiser Begins This Wednesday June 1st Print Out The Voucher And Make Plans To Dine There Soon Fundraising Voucher Print

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Indiana Estimated Tax Payments 2021 Fill Online Printable Fillable Blank Pdffiller

Banking Resolution Of Corporation Legal Forms Banking Corporate

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

/1099g-b89de84cce054844bd168c32209412a0.jpg)